Bought some shares 10/17 and 10/21 (and some shares a several days later) as I caught the market pull back during a time of global unrest, during a time of fund managers selling massive shares to find other stocks to meet year end goals, and during a time of Ebola scares.

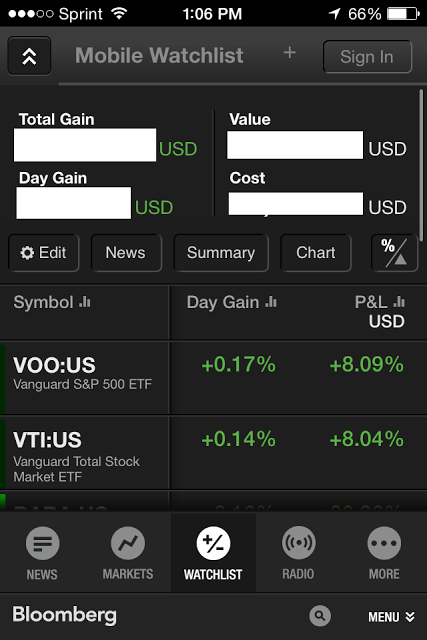

Over a period of about three weeks (screenshots from yesterday) I am enjoying very nice capital gains with the exception of Intel in which I am long as to outpacing the S&P 500 at some point in the future. Overall, I came up a winner in my book.

Over a period of about three weeks (screenshots from yesterday) I am enjoying very nice capital gains with the exception of Intel in which I am long as to outpacing the S&P 500 at some point in the future. Overall, I came up a winner in my book.

Over 20% gains in Delta and Alibaba. And for the mathematically challenged...if I had $100,000 invested in Delta or Alibaba I would come away with capital gains of a little over $20,000 in three weeks for that position...which is more than historical yearly inflation rates and more than yearly historical S&P 500 rates of return. 10/17/14 - 11/10/14 I have done better than the S&P 500 and the total market return.

Using simple fundamental comparison of the the stock's industry & the stock's competitors I found high-quality undervalued stocks in companies I understand/interest in/products I use. Also, paying attention to the news (twitter, CNBC, a little Bloomberg) and making sure the respective CEO's have a history of making competent decisions was an integral part of my decision making process.

I believe starting with undervalued stocks is a good point for success and taking advantage of any news (within reason) to catch the stock at a low price is key even if it means adding to a position during market weakness....Buy weakness and sell strength is the motto! I do not feel option plays are worth the time as a lot of luck is involved in predicting the rise/decline of stock prices at a future date.

Exit points are up to you as if you want to wait for P/E to better align with the industry and competitors...or you are comfortable beating inflation by a decent margin and want to bail out. If the stocks pays a dividend that is higher than fairly-safe bond choices you could hang onto the stock almost forever similar to a Warren Buffet and ride stock price gains/losses for a long period of time. Also, an exit point could simply be determined by tax ramifications.