Saturday, March 21, 2015

Binary Options are Gambling...PERIOD!!!

Bet Over or Under on the future price of a security at a specific point in time. One does not own the underlying assets being the securities.... just like you do not own the sports team or player in which you place a wager. Binary options are not an investment vehicle at all. Binary options do not carry the right nor carry to obligation to the underlying asset; not to be confused with options in which one has the right, but not the obligation to trade the underlying assets.

For more information about binary options....ya know, if you are into gambling; feel free to check-out the following investopedia link: http://www.investopedia.com/video/play/binary-options/

Stock Buyback (Repurchase).

"A program by which a company buys back its own shares from the marketplace, reducing the number of outstanding shares. Share repurchase is usually an indication that the company's management thinks the shares are undervalued. The company can buy shares directly from the market or offer its shareholder the option to tender their shares directly to the company at a fixed price.

The buyback also helps to improve the company's price-earnings ratio (P/E). The P/E ratio is one of the most well-known and often-used measures of value. At the risk of oversimplification, when it comes to the P/E ratio, the market often thinks lower is better. Therefore, if we assume that the shares remain at $15, the P/E ratio before the buyback is 75 ($15/20 cents); after the buyback, the P/E decreases to 68 ($15/22 cents) due to the reduction in outstanding shares. In other words, fewer shares + same earnings = higher EPS! Based on the P/E ratio as a measure of value, the company is now less expensive than it was prior to the repurchase despite the fact there was no change in earnings.

Another reason that a company may move forward with a buyback is to reduce the dilution that is often caused by generous employee stock option plans(ESOP)."

( http://www.investopedia.com/terms/s/sharerepurchase.asp )

Investopedia perfectly summed-up a stock buyback; no further words are needed by me..... : -)

Friday, March 20, 2015

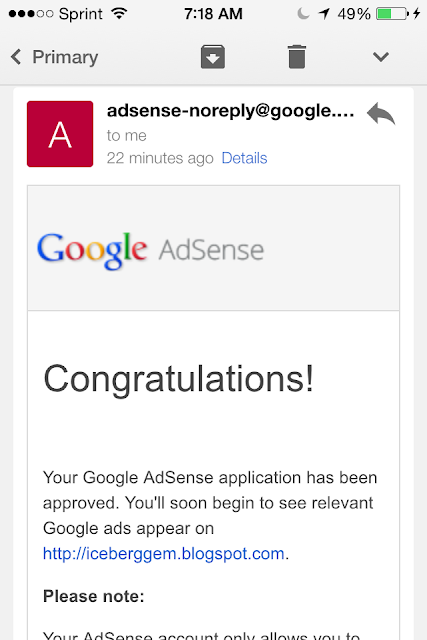

How I obtained Google Adsense 14 Blog post into the game! #monetization

Google told me I needed more content and to try again in the future. I read on various forums that one needed at least 30 high quality blog post over a period of one year. So, when the button for Adsense lit up on my blogger account after my 13th post (6 months of posting) I was in shock!

Yes, the sign up button for Adsense lit up one day after my 13th post, but clicking on the button did not load the form for sign up. Immediately after my 14th post the button/link to sign up for Adsense was usable. I did not have a top level domain on the blog and the other links on the blog mirrored the info on the website of my top-level domain that had at that time.

Dilution is NOT the same as a Stock Split!!!

A stock split does not change the ownership percentage of investors. A stock split is simply an increase of shares outstanding by a set multiple. However, dilution is "a reduction in the ownership percentage of a share of stock caused by the issuance of new stock. Dilution can also occur when holders of stock options (such as company employees) or holders of other optionable securities exercise their options. When the number of shares outstanding increases, each existing stockholder will own a smaller, or diluted, percentage of the company, making each share less valuable. Dilution also reduces the value of existing shares by reducing the stock's earnings per share." ( http://www.investopedia.com/terms/d/dilution.asp )

ex. If 10 people own 2 shares each of a company (100% of the available shares) and 20 addition shares are authorized; the shares for the original holders has an ownership decrease of 50%.

Wednesday, March 18, 2015

Reverse Stock Split.

"In the vast majority of cases, a reverse split is undertaken to fulfill exchange listing requirements. An exchange generally specifies a minimum bid price for a stock to be listed. If the stock falls below this bid price, it risks being delisted. Exchanges temporarily suspend this minimum price requirement during uncertain times; for example, the NYSE and Nasdaq suspended the minimum $1 price requirement for stocks listed during the 2008-09 bear market. However, during normal business times, a company whose stock price has declined precipitously over the years may have little choice but to undergo a reverse stock split to maintain its exchange listing. "

Subscribe to:

Comments (Atom)