Late April I decided to add new positions in $LEG and $GIS.

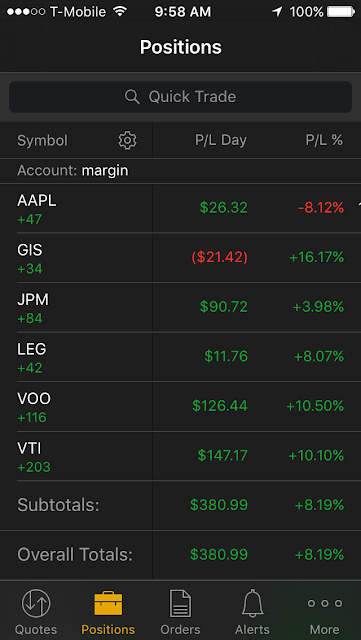

From late April until Mid-July I gained 16% on $GIS and I gained 8% on $LEG. $AAPL was still a struggle during Mid-July, but I have a slight break over even as of Mid-August.

The profits I had taken from July on $GIS was 16%. In simple terms without taking into account dividends and not taking into account weight of positions since the beginning of The Paper Trade Series ...aka assuming all things equal: 16%GIS, 16%CSCO, 16%WMT 16%SBUX -19%GNC = 7.9% Capital Gains on the sidelines which puts me just below my benchmarks of VTI and VOO.

My ultimate goal is to outpace the broad indices. I will have to be patient on waiting for $AAPL, $JPM, and $LEG to take off and I may have to add a new position in another corporation to reach my goal sooner at a faster pace, but only if the proper opportunity presents itself. Discipline...Discipline... Discipline.