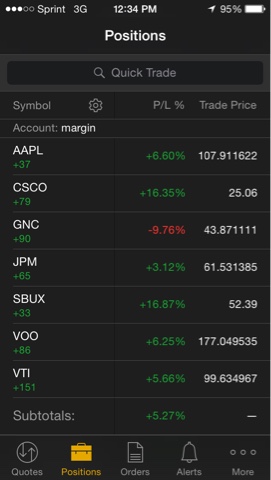

Had to get out of GNC because news just broke that they put illegal- synthetic drugs into some of their products and therefore I took about a 19% loss. The main essence of GNC is ingredients and people trusting GNC for their body. I was skeptical about the stock as it did not follow my investment strategy upon a second check, but I remember an early on pop in the price and analysis all-over marked it as a buy till this day. I was thinking when I wrote part 4 of the paper trade earlier today about the cause of stock declining....and I could not find anything on the internet to indicate any issues. It would have been my best bet to cut my losses much earlier as I was not confident in my stock selection, but I let outside influence albeit professional analysis break me.

However, I invested in a diverse portfolio to mitigate my GNC loss to keep me in-line with the s&p500 and total index so I am okay. I will bounce back with my next selection(s) to outpace the s&p500 and total index. I must stick to my script and I can live with such set-backs if it is 100% in-line with my strategy.

The Paper Trade series has been a show-and-tell so it includes the good, bad, and bouncing back. This GNC loss was a reminder and another learning experience to not be swayed by anyone else when doubts arise.