Please feel free to zoom in your browser to the make the images larger. Oh yeah, and the following information can be extrapolated to cover other mobile stock tracker apps:

Iceberg Gem

Investing and Personal Finance

Monday, February 11, 2019

How to Read a Stock Quote on an iPhone (iOS 12 Remix)

Please feel free to zoom in your browser to the make the images larger. Oh yeah, and the following information can be extrapolated to cover other mobile stock tracker apps:

Wednesday, March 22, 2017

The Paper Trade Part 9

10/10/16

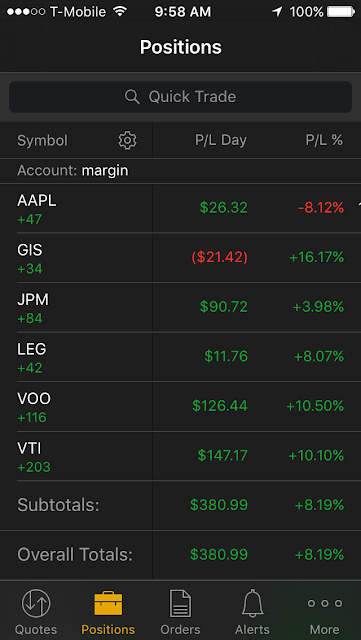

October 10th 2016 I bought my first shares of MELI. I bought the equivalent amount for the VOO and for the VTI per usual. Also, I bought additional shares of LEG.

10/14/16

October 14th 2016 I bought additional shares of MELI. I bought the equivalent amount for the VOO and for the VTI per usual.

11/7/16

The profits (closed position) I had taken on November 7th 2016 $JPM was 14.5%. In simple terms without taking into account dividends and not taking into account weight of positions since the beginning of The Paper Trade Series ...aka assuming all things equal: 14.5%JPM 16%GIS, 16%CSCO, 16%WMT 16%SBUX -19%GNC = 9.91% Capital Gains on the sidelines which puts me just above my benchmarks of VTI and VOO on 11/7/16.

However, I still have $APPL, $LEG and $MELI in the portfolio and I waiting/sticking with those stocks until they can be included to get me above the VTI and VOO.

12/8/16

I bought additional shares of $MELI.

Thursday, August 11, 2016

The Paper Trade Part 8

Late April I decided to add new positions in $LEG and $GIS.

From late April until Mid-July I gained 16% on $GIS and I gained 8% on $LEG. $AAPL was still a struggle during Mid-July, but I have a slight break over even as of Mid-August.

The profits I had taken from July on $GIS was 16%. In simple terms without taking into account dividends and not taking into account weight of positions since the beginning of The Paper Trade Series ...aka assuming all things equal: 16%GIS, 16%CSCO, 16%WMT 16%SBUX -19%GNC = 7.9% Capital Gains on the sidelines which puts me just below my benchmarks of VTI and VOO.

My ultimate goal is to outpace the broad indices. I will have to be patient on waiting for $AAPL, $JPM, and $LEG to take off and I may have to add a new position in another corporation to reach my goal sooner at a faster pace, but only if the proper opportunity presents itself. Discipline...Discipline... Discipline.

Saturday, June 4, 2016

Inbox Dollars is Legit (but not worth the time)

Inbox Dollars as a simple source of extra money in terms of active participation is a waste of time. It took me from 12/28/15-6/4/16 to earn $37. Anything online that is active (clicking emails, surveys, watching videos, etc) should pay you at least 10-cents per minute (The M-turk decent average, but maybe I'll explain M-turk in a futer blog post) . Clicking for the next video, emails, surveys etc is considered being active. However, outside of emails and downloading apps (1 time limit) you cannot actively earn at least 10-cents per minute.

Here are the means of my earnings:

Video earnings have a low return (10-cents for watch 100 15-30 seconds videos) for having to actively select the next video:

Videos, search, downloading apps, emails, & surveys are the primary vehicles to make money without having to sign up with an advertising partner for goods or services. However, surveys can act strange in which you could waste 10-minutes...and then are told you don't qualify for the survey. If you don't mind signing-up with different advertising partners for their goods or services it may be worth your time to earn money passively with Inbox Dollars.

The cash out minimum is $30, but there is a $3 processing fee. That fee can be waived on first cash-out if you attempt to cash-out at $30 and then inbox Dollars gives you 30 days to reach $40...and therefore you don't get hit with a processing fee. But as I said earlier, I cashed out at $37.

Anyways, once you cash out you need to remain active everyday by checking a paid email or watching a video until the check comes in the mail or a gift card is credited.

My time is better doing something else for active money. I plan to stick with Perk as a money earning app(s) as it is passive money that does not take my time away from engaging in more productive methods of earning money online.

Subscribe to:

Comments (Atom)